Crypto CFD Trading: Key Benefits of Cryptocurrency CFD Trading

Cryptocurrencies have been making headlines in recent years, but trading them the traditional way isn’t always convenient.

Buying and storing digital assets comes with its fair share of challenges—security risks, complex wallets, and market volatility. That’s where Crypto CFD trading comes in.

In this article, we’ll break down:

- What Crypto CFD trading is and how it works

- The key benefits, including flexibility, leverage, and ease of access

- How to get started trading crypto CFDs with Switch Markets

- How to use crypto trading CFD calculators to optimize your strategy

What is Crypto CFD Trading?

If you’ve never heard about CFDs, here’s a short intro: they are simply financial derivatives that enable traders to speculate on the price movements of an asset, such as cryptocurrencies, without taking ownership of the underlying assets. In other words, it’s an agreement between you and another side (normally the brokerage firm) to solely speculate on the price of an underlying asset. There’s no need to physically transfer the asset, like the traditional method of trading stocks, commodities, and digital currencies (meaning via exchanges).

When you trade crypto CFDs, you're basically entering into an agreement with a broker to exchange the difference in the asset's price from the moment the contract is opened to when it's closed. And for that reason, there are many benefits to trading crypto CFDs compared to trading the underlying asset via exchanges of the physical market.

So, How Does It Work?

Let’s say you're interested in buying and selling Bitcoin but don't want to go through the process of purchasing and storing it via the exchange or the open market. With crypto CFD trading, you can open a position based on your prediction of Bitcoin's price movement:

- Going Long: If you anticipate that Bitcoin's price will rise, you open a 'buy' position. If the market moves in your favor, you profit from the upward price movement.

- Going Short: If you believe the price will decline, you open a 'sell' position. Profits are realized if the asset's price falls as predicted.

The basic idea of crypto CFD trading is that you do not own Bitcoins, for that matter. You simply speculate on Bitcoin's price, which means that you do not physically own Bitcoins.

This flexibility allows traders to navigate various market conditions without the need to own the cryptocurrency itself.

Not only that, there are many other benefits to trading cryptocurrency CFDs, which we will discuss in the next section.

When you trade crypto CFDs, you're basically entering into an agreement with a broker to exchange the difference in the asset's price from the moment the contract is opened to when it's closed. And for that reason, there are many benefits to trading crypto CFDs compared to trading the underlying asset via exchanges of the physical market.

Key Benefits of Trading Cryptocurrency CFDs

If you’re looking for a more flexible way to trade cryptos, then you may want to give cryptocurrency CFDs a try. This approach offers several advantages that can make your trading experience more streamlined and potentially more profitable. Let’s check a few of them out:

1. No Need for Digital Wallets

One of the primary hurdles in traditional cryptocurrency trading is the necessity of managing digital wallets. These wallets are essential for storing your crypto assets securely, but they come with their own set of challenges, including security risks and the complexity of setup and maintenance. We’ve all heard the stories of those who lost their digital wallets or their password to access their wallets. There’s no other way to say it - storing cryptos on a digital wallet is not yet a simple process.

When trading cryptocurrency CFDs, you sidestep this requirement entirely. Since CFDs are only financial derivatives that allow you to speculate on the price movements of cryptocurrencies, there's no need to worry about wallet security or the potential loss of private keys.

2. Ability to Short Sell Cryptocurrencies

The cryptocurrency market is known for its volatility, with prices capable of swinging dramatically in short periods. While this volatility can lead to substantial gains, it also presents opportunities to profit from declining prices.

Traditional cryptocurrency exchanges often don't support short selling, limiting traders' ability to capitalize on bearish market movements. In contrast, CFD trading platforms typically offer the option to short-sell cryptocurrencies without any specific requirements. This means you can open positions that profit when the price of a cryptocurrency falls.

3. Streamlined Registration Process

Getting started with cryptocurrency trading on traditional exchanges often involves a lengthy registration and verification process. This can include identity verification, proof of address, and sometimes even background checks, leading to delays before you can begin trading.

CFD brokers, especially those that are well-regulated like Switch Markets, often offer a more streamlined onboarding process. While they still adhere to regulatory requirements, the procedures are typically more straightforward, allowing you to start trading more quickly.

4. Regulation and Security

The regulatory environment surrounding cryptocurrencies can be murky, with many exchanges operating without clear oversight. This lack of regulation can lead to concerns about the security of your funds and the fairness of the trading platform.

In contrast, many CFD brokers are regulated by reputable financial authorities, such as the Cyprus Securities and Exchange Commission (CySEC).

5. Easier Deposit and Withdrawal Processes

Depositing and withdrawing funds from traditional cryptocurrency exchanges can sometimes be a cumbersome process. Regulatory restrictions, banking issues, and the inherent complexities of blockchain transactions can lead to delays and complications, especially in certain jurisdictions. In some cases, you might not be able to withdraw funds from your crypto exchange to your country (it happened to me).

CFD brokers, operating under established financial regulations, often provide more straightforward and faster deposit and withdrawal methods for fund transfers. They typically support a variety of payment options, including bank transfers, credit/debit cards, and even e-wallets, making it more convenient to manage your funds. For instance, Switch Markets offers 14 deposit and withdrawal payment methods, including the ability to deposit and withdraw funds using cryptocurrencies.

6. Leverage and Margin Trading

One of the standout features of CFD trading is the ability to use leverage. Leverage allows you to open positions larger than your initial investment, amplifying both potential gains and losses.

For instance, with a leverage ratio of 10:1, a $1,000 investment can control a $10,000 position. While this can significantly enhance profit potential, it's crucial to understand that it also increases risk. Therefore, it is advisable to use a forex margin calculator to manage your position effectively.

Proper risk management strategies are essential when trading on margin to prevent substantial losses. Many CFD brokers offer adjustable leverage options, enabling you to choose a level that aligns with your risk tolerance and trading strategy. For instance, here at Switch Markets, we offer users the ability to use dynamic leverage, which is a type of leverage that automatically changes based on the position’s condition.

7. Access to a Wide Range of Cryptocurrencies

While a few years ago, CFD brokers offered a limited selection of cryptocurrencies, nowadays, these brokers often have a wide range of cryptos to choose from. This includes altcoins and emerging cryptocurrencies that may not be listed on traditional exchanges.

For example, Switch Markets offers traders a selection of 67 cryptocurrencies, including the most popular and trendy crypto coins. These include, among others, Bitcoin, Ethereum, Ripple, Trump coin, Melania coin, Cosmos, Avalanche, Sandbox, Solana, Harmony, Dogecoin, Shiba Inu, and many more. Switch Markets offers new listed coins, such as the Ethereum Names Service (ENS) coin or the TRUMP coin.

8. Professional Trading Platform and Tools

Another key benefit of crypto CFD trading is the ability to use a professional trading platform and trading tools. Unlike crypto exchanges, which often provide a complicated trading experience or a very simple trading platform, CFD brokers provide a professional and easy-to-use trading platform.

At Switch Markets, traders can choose to trade crypto CFDs on the popular MetaTrader 4 or MetaTrader 5, two of the most popular and professional trading platforms in the market.

How to Trade Crypto CFDs with Switch Markets

Trading crypto CFDs with Switch Markets is a straightforward process. Here's a concise guide to help you start trading crypto CFDs:

1. Open an Account with Switch Markets

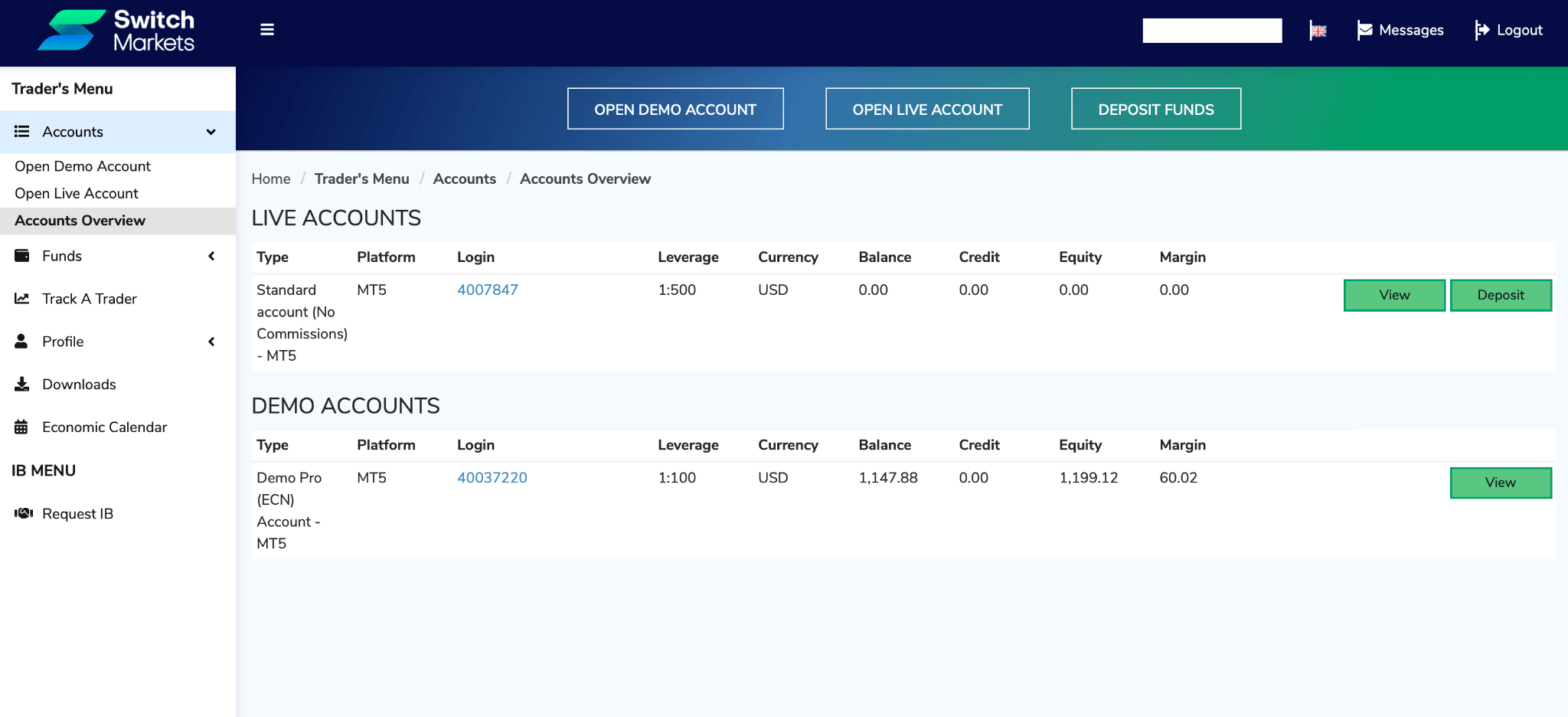

First, visit the Switch Markets website and click on "Open Account." Fill out the registration form with your personal details and submit the required identification documents to verify your account. This step ensures compliance with regulatory standards and secures your account.

Once your account is verified, you’ll get access to the Switch Markets client terminal, where you can manage your account, open a demonstration account, download platforms, deposit and withdraw funds, view the economic calendar, become an IB (Introducing broker), and add our built-in tracking application, Track A Trader, to track and analyze your trades.

2. Deposit Funds

Switch Markets requires a minimum deposit of $50, making it accessible for traders at various levels. You can choose from a variety of deposit methods, including bank transfers, credit/debit cards, and digital payment options. You can visit this guide to learn how to deposit funds using Bitcoin and other cryptocurrencies.

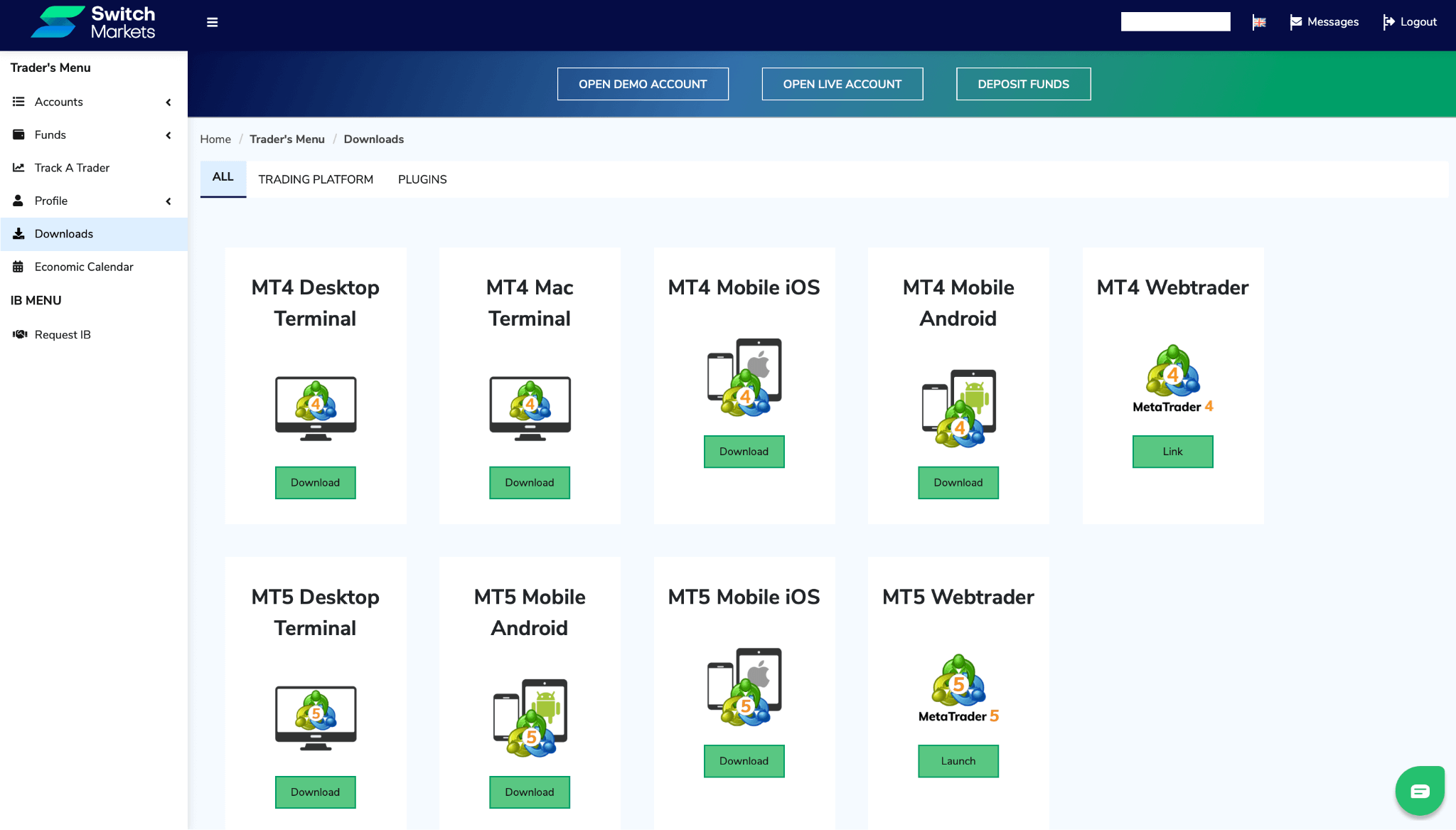

3. Download the Trading Platform

Switch Markets offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, both as a desktop app or a web application. Download your preferred platform directly from the Switch Markets client terminal and install it on your device.

Then, use the credentials provided upon account approval to log into the trading platform.

4. Select Your Cryptocurrency CFD

Switch Markets provides access to popular digital currencies, including Bitcoin, Ethereum, Litecoin, Ripple, Dash, and Bitcoin Cash on MT4 and over 60 more options when you choose the MT5 platform.

Use the platform's analytical tools to assess market conditions and decide which cryptocurrency CFDs align with your trading strategy.

5. Place Your Trade

Now, you can place your crypto CFD trade. Choose between market orders for immediate execution or pending orders to set specific entry points. Determine the size of your position based on your risk management plan.

Take note that Switch Markets offers leverage up to 1:3 for cryptocurrency CFDs, allowing you to control larger positions with a smaller initial investment.

As you can see in the image above, once you click on the crypto you wish to buy or sell, you can then navigate to the new order button and click on it. Then, a new window will pop up where you can place your order. At this point, you’ll have to decide on the type of order and the size of the trade. You can also place a stop loss and take profit to manage your positions.

6. Monitor and Manage Your Trade

Lastly, keep an eye on your open positions using the platform's real-time monitoring features.

It is also important to use our tracking application, Track A Trader, a free feature available for Switch Markets users, that tracks all your trades and allows you to easily analyze your trading performance.

Following these steps helps you to seamlessly begin trading cryptocurrency CFDs with Switch Markets, leveraging their robust platform and supportive trading environment to navigate the dynamic crypto market.

How to Use Our Crypto Trading CFD Calculator

A crypto trading CFD calculator is an essential tool for both novice and experienced traders. It helps in assessing potential outcomes of trades, managing risk effectively, and making informed decisions without manual computations.

At Switch Markets, we have two of these calculators that provide instant insights into various aspects of trading, such as potential profit and optimal position sizing. Here’s how you can use these calculators:

Switch Markets' Forex Profit Calculator

Our Forex Profit Calculator (which works perfectly for Crypto CFDs) is designed to estimate the potential profit of a trade before execution. Here's how to utilize it:

1. Select the Trading Instrument: Choose the specific cryptocurrency pair you intend to trade.

2. Specify Account Currency: Indicate the base currency of your trading account.

3. Input Trade Details:

- Volume: Enter the size of your trade in lots.

- Open Price: Input the price at which you plan to enter the trade.

- Close Price: Input the anticipated closing price of the trade.

4. Calculate: Click on "Calculate Profit" to view the potential profit for the trade.

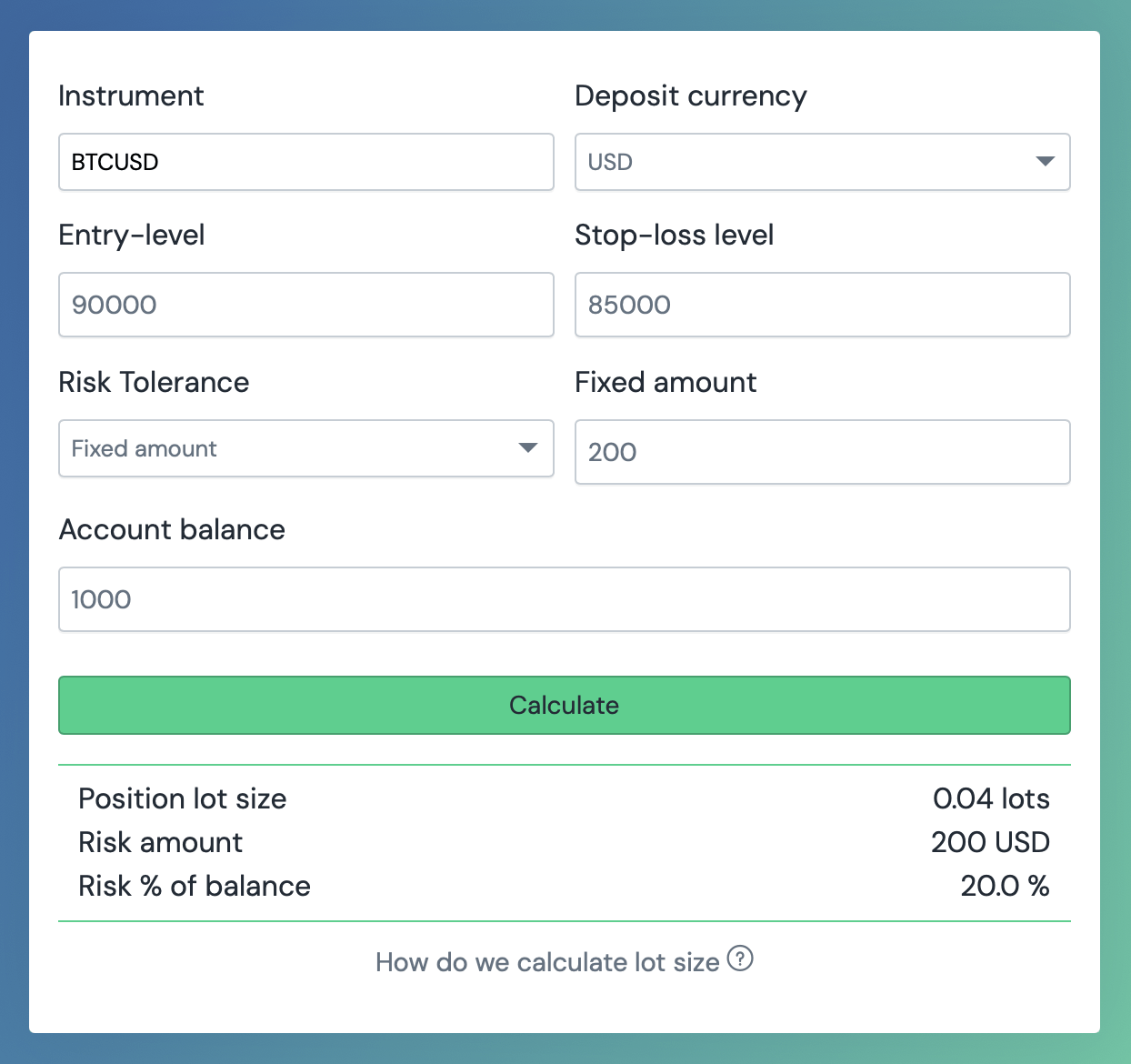

Switch Markets' Lot Size Calculator

Our Lot Size Calculator can also assist in calculating the appropriate lot size based on your risk tolerance and account balance. Follow these steps:

1. Select the Instrument: Choose the cryptocurrency pair you wish to trade.

2. Set Account Details:

- Deposit Currency: Specify your account's base currency.

- Account Balance: Enter the total balance of your trading account.

3. Define Trade Parameters:

- Entry Level: Input the price at which you plan to enter the trade.

- Stop-Loss Level: Set the price at which you intend to exit the trade to prevent excessive loss.

4. Determine Risk Tolerance: Specify the percentage of your account balance you are willing to risk on the trade.

5. Calculate: Click on "Calculate" to determine the optimal lot size for your trade.

Below, you can see an example of using our lot size calculator for a BTC/USD trade.

Why Is Switch Markets the Best Crypto CFD Trading Platform?

With so many crypto CFD trading platforms out there, finding the right one can feel overwhelming. But if you’re looking for a place that offers a solid mix of crypto CFD options, competitive trading conditions, a variety of free trading tools, and a smooth experience, Switch Markets is the broker of choice.

You get access to around 67 popular digital currencies, so there’s plenty of room to diversify and explore different market opportunities.

Tight spreads also make a huge difference when it comes to trading costs, and Switch Markets keeps them as low as 0.0 pips for some assets if choosing our ECN account.

What’s more, you don’t have to worry about hidden fees or sketchy practices. Everything is upfront, and with regulatory oversight, your funds are kept safe.

On top of that, Switch Markets gives you access to more than just crypto—you can also trade forex, indices, commodities, and shares all in one place, which is great if you like to switch things up.

And let’s be real—good customer support can make or break your experience. If you ever need help, Switch Markets has solid support channels to keep things running smoothly. This is something that, unfortunately, is not often provided by many crypto exchanges.

Finally, there are also useful advanced trading tools, including calculators and a free VPS for those who open a trading account. So, if you’re just getting started or refining your strategy, Switch Markets is a platform that gives you the right mix of features without overcomplicating things.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.