Algo Trading: The Basics and How to Get Started

- Understanding Algo Trading - What is Algo Trading?

- How Does Algorithmic Trading Work?

- Getting Started with Algo Trading

- Risk Management in Algo Trading

- Useful Resources for Algo Traders

- Key Factors to Consider When Choosing an Algo Trading Broker

- Summary - How to Start Algo Trading

- Frequently Asked Questions

Algo Trading - Listen to the Full Article Here

Algorithmic trading, often called algo trading, is a trading method that uses computer algorithms to execute trades automatically. It is an exciting way to trade the markets, one that, if done correctly, can provide you with a winning formula to constantly make profits in the markets.

If you’re looking to understand algo trading, the basics, and how to get started, this guide will help. We’ll cover what algo trading is, the key components involved, and the steps to launch your first algorithmic trading strategy.

Key Takeaways

Understanding Algo Trading - What is Algo Trading?

Algorithmic trading, also known as algo or automated trading, is a trading technique that combines computer software and financial markets to execute trades automatically based on predefined rules. In other words, it’s an attempt to create a trading bot that automatically places orders in the market based on advanced mathematical models.

Algo trading formulas are often made using programming languages, including Python, Java, C++, and more. Alternatively, it can also be done using the specific programming language on which a specific platform is built. For example, MetaTrader 4 and 5 are based on MQL4 and MQL5, respectively. The coding language for TradingView is Pine Script, and Microsoft C# for NinjaTrader.

The goal of algorithmic trading is to master dynamic short-term trading strategies, minimizing human intervention and emotional biases, thereby ensuring that trading decisions are made with precision and consistency. Unlike traditional trading methods, where human traders may fall prey to emotional decision-making, algorithmic trading follows strict guidelines, reducing the chances of errors and slippage during trade execution.

Fundamentally, it is possible to enter and exit hundreds of trades in a day; all is done automatically based on predefined rules. Algo traders often use a combination of technical analysis or fundamental analysis rules, and risk management techniques. This enables them to identify good entry points while using stop loss and take profit orders to exit positions.

This method is legal and widely accepted, driven by technological advancements that continue to push its adoption.

How Does Algorithmic Trading Work?

So, how does algo trading actually work? Well, like many other things, there’s more than one way to utilize algo trading, although in all cases, the goal and the general concept are the same.

Generally, algorithmic trading refers to the use of computer programs to automatically execute trades based on predefined rules. These algorithms can make multiple buy and sell decisions in microseconds or even nanoseconds, a feat impossible for human traders. This rapid execution capability is particularly beneficial in high-frequency trading, where the ability to act on market signals faster than competitors can lead to significant profits.

The trading process involves creating a trading strategy, coding it into a trading algorithm, and backtesting it against historical market data to evaluate its performance. These algorithms can analyze vast amounts of data and indicators simultaneously, identifying patterns and opportunities that may not be evident to human traders. Automation in algorithmic trading removes human emotions from decisions, resulting in more consistent and reliable outcomes.

For example, let’s say we automate our trading system based on moving average crossovers. These will be our predefined trading conditions for our entry and exit levels. Every time one moving average crosses above the other moving average indicator, an entry signal is given. Once a crossover occurs again, an exit signal is generated.

This is, in a nutshell, how algorithmic trading works. However, you should note that there are plenty of ways for developers and algorithmic traders to use in order to generate trade ideas. It could be using technical analysis, fundamental analysis, and other factors that may generate signals.

Generally, algorithmic trading refers to the use of computer programs to automatically execute trades based on predefined rules. These algorithms can make multiple buy and sell decisions in microseconds or even nanoseconds, a feat impossible for human traders. This rapid execution capability is particularly beneficial in high-frequency trading, where the ability to act on market signals faster than competitors can lead to significant profits

Getting Started with Algo Trading

Starting your journey in Algo trading requires a structured approach. Begin by doing the following:

- Learn the basic concepts of algorithmic trading.

- Choose an asset class that aligns with your expertise.

- Select a reliable trading platform and brokerage firm.

- Understand the key tools you need to utilize algorithmic trading.

- Develop a robust trading strategy.

- Backtest your trading strategy on a paper trading account.

- Transitioning to live trading.

Following these steps will help you transition smoothly from manual trading to automated trading, ensuring that you are well-prepared to navigate the world of algorithmic trading.

1. Learning Basic Concepts

The first step in learning algorithmic trading is to understand the basic concepts of programming, market behavior, and strategy design. This means you must understand the different ways algo trading works. Are you going for high-frequency trading? If so, you might have to invest in a strong computer and place your servers close to a certain exchange or your brokerage firm.

Otherwise, if you plan to make small profits by using a predefined set of rules, then you'd better find a good trading platform with low fees and a reliable connection.

Also, you need to decide if you wish to learn programming or find another solution for that - Use AI software, hire a developer, or simply choose copy trading. For those new to programming, Python is a commonly used language in algorithmic trading due to its simplicity and vast libraries. Other popular languages among algo traders include C, C++, and C#. However, if you plan to program via MetaTrader 4 and 5, then you might have to learn MQL4/5.

Last, understanding market dynamics and having a solid background in trading knowledge will further enhance your ability to develop effective trading strategies. For that matter, you need to explore the different ways automated trading can be based on. These include fundamental analysis, hence, entering and exiting positions based on economic data releases and even analyzing central bankers’ speeches. If opting for the analytical side, then you might want to find an economic technical analysis indicator or a certain trade signal that provides good entry and exit levels.

2. Choosing an Asset Class

Choosing the right asset class is crucial for effective algo trading. Each asset class, whether it’s stocks, forex, or commodities, has unique characteristics that can significantly affect trading outcomes.

Select an asset class that aligns with your interests and areas of expertise to ensure better engagement and results.

3. Select a Reliable Trading Platform and Brokerage Firm

An effective trading platform is crucial for executing algorithmic strategies. It ensures robustness in trade execution. Platforms like Switch Markets’ MT4/5 offer advanced features, real-time market data, and low latency, making them ideal for algo traders.

When choosing a trading platform, consider factors such as execution speed, supported asset classes, backtesting capabilities, and user interface. It is also crucial to understand the difference between account types - ECN vs. Standard, and their impact on the trading costs. If, for example, you are opting for scalp trading, then an ECN account might be the best option for you.

You also need to consider whether the brokerage firm supports algo trading activities. Switch Markets, for example, is a platform that provides all the necessary tools for algo traders.

4. Use the Right Tools to Enhance Performance

To succeed in algorithm trading, you need access to top-notch trading tools and services. Here, at Switch Markets, we offer tools that are specifically designed for algorithmic trading, including:

Free Virtual Private Server (VPS) - Algo traders who open an account with Switch Markets get a free VPS for their Expert Advisors and algo trading strategies.

Risk Manager EA - We also offer the risk management EA tool that enables traders to automatically calculate the position size based on different variables.

Expert Advisor Tools - In addition to the risk manager EA, Switch Markets also provides different Expert Advisor (EA) tools to help you automate your trading. These include the support and resistance indicator EA, live currency strength Meter EA, Value at Risk (VAR) EA, the Correlation Trader EA, and Session Map EA.

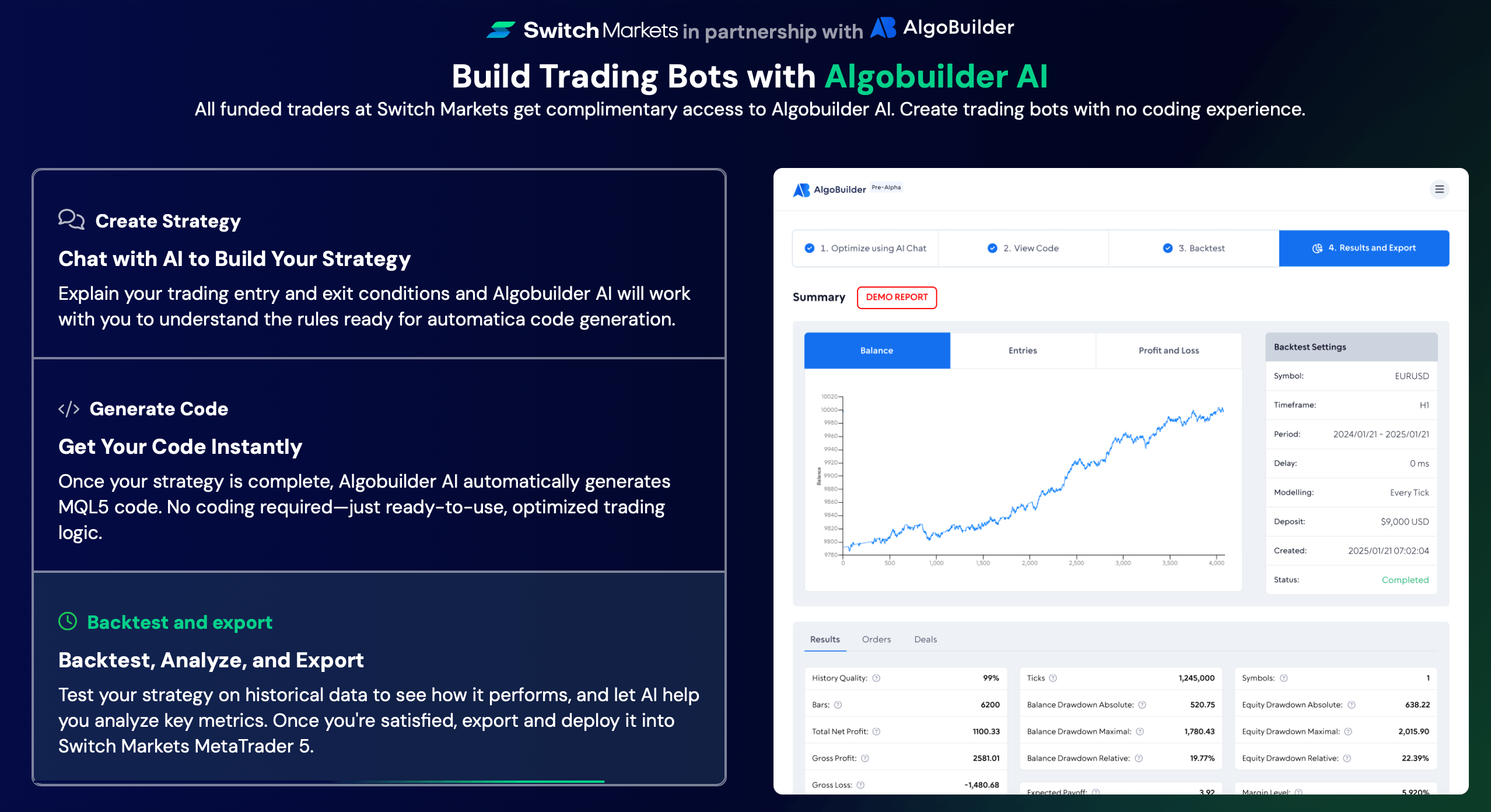

In addition to the above, Switch Markets provides one of the most advanced tools for building automated trading strategies without having to know any programming or coding. This is known as an AI trading bot. On Switch Markets, all funded traders get complimentary access to Algobuilder AI, which is an Artificial Intelligence trading bot that enables you to code trading strategies and automatically insert them into your MT4/5 trading platform.

5. Developing a Trading Strategy

Now, it’s money time. Developing a robust trading strategy is the core of algorithmic trading activities. A trading strategy consists of a set of rules or defined instructions to execute trades based on specific conditions. The process of developing a trading strategy involves defining entry and exit conditions, setting risk management parameters, and testing the strategy thoroughly before deployment.

When building initial trading strategies, it’s recommended to keep them simple and basic. Common algorithmic trading strategies include trend-following, mean-reversion, and arbitrage. But here’s where you need to be creative and find the hack that might generate profits for you.

6. Backtesting and Paper Trading

The last thing you need to do before deploying your algorithm in live markets is backtest and paper-trade your strategies. In other words, use a demo account to verify that your chosen indeed works.

These steps help evaluate the performance of your algorithm using historical data and simulated trading environments, ensuring that you are well-prepared for real-world trading scenarios.

The purpose of backtesting is to assess the potential profitability and risk of a strategy based on past market data. By verifying your trading technique on historical data, you can identify any weaknesses and make necessary adjustments before deploying the algorithm in live markets.

7. Transitioning to Live Trading

Transitioning from paper trading to live trading is the last step in your algorithmic trading journey. It’s advisable to start with a small amount of capital to manage risk more effectively. This cautious approach allows you to monitor the algorithm’s performance in real market conditions without exposing yourself to significant financial risk. As you gain confidence and your algorithm proves its reliability, you can gradually increase your position size and your total investment.

After you have applied your automated trading strategies in live markets, ongoing monitoring of your algorithm is essential to ensure it operates correctly and adapts to changing market volatility. Market dynamics can shift unexpectedly, requiring potential adjustments to your algorithm post-launch.

Most importantly, using a Virtual Private Server (VPS) is a must-have tool for Algo traders. A VPS can help minimize downtime and ensure your trading platforms and algorithms run 24/7, even when your personal computer is turned off. This setup provides a stable and reliable environment for your trading activities.

Risk Management in Algo Trading

In 2012, a famous algorithmic trading company called Knight Capital Group lost $440 million in less than an hour. Why? It was due to a malfunctioning algorithm, which sent incorrect orders into the market.

And, if that happened to them, it can surely happen to you.

Effective risk management is vital in algorithmic trading to maintain a balance between potential returns and market exposure. Remember, you are dealing with automated trading, which makes you the gatekeeper to your trading account. Human oversight is essential to respond to unforeseen market changes and make necessary adjustments to your algorithms.

But that’s not all. Setting clear risk management parameters like stop-loss and take-profit levels helps safeguard capital and optimize the risk-reward ratio of trading strategies. Additionally, you can use automated risk management tools to ensure your account is well protected from unexpected black-swan events.

For that matter, we suggest downloading our key risk management EA tools, including the risk manager EA tool and the Value At Risk EA.

Besides those, there are several key factors you must apply to effectively manage your risk in algo trading:

Stop Loss and Take Profit

Perhaps the most important risk management tool you must integrate into your automated trading model is setting clear stop-loss and take-profit orders. This should be per trade and periodically, whether daily, weekly, or monthly.

This is a proven method to reduce risks, as setting stop losses can ensure you always have a predefined amount you are willing to lose per trade.

Bear in mind that some algo traders even use two stop loss levels in case the market avoids one as a result of slippages or any other operational malfunction.

Position Sizing

Position sizing is another risk management technique you must utilize in your algo trading strategies. By allocating a suitable amount of capital to each trade, traders can minimize their risk of losses and safeguard their overall trading funds. This strategic approach helps distribute risk across individual trades, promoting more stable returns and sustained performance in trading portfolios.

For more information about position sizing, you can visit our lot size calculator.

Run Your Platform on a Virtual Private Server

As previously mentioned, there are also technological risks associated with algorithmic trading. Some of these include latency, slippages, internet disconnection, and power outages. Indeed, serious issues for those who wish to automate their trading.

Keep in mind that algo traders normally run their automated trading strategies around the clock to capture as many trades as possible, even when they go to sleep or are not in front of their screens.

The solution to these technological issues? A VPS.

A Virtual Private Server essentially means you host your trading platform on a dedicated server to benefit from an uninterrupted trading experience, lower latency and slippages, and high-speed execution. In short, a VPS is a must-have risk management tool for algo traders.

Get a Free VPS with Switch Markets

Useful Resources for Algo Traders

Obviously, after reading this guide, you have a sense of how to get started with algorithmic trading. Yet, if you want to be an algo trading expert, you must take all the steps to increase your knowledge and your chances of success.

A wealth of resources is available to help algo traders enhance their skills and knowledge. Books like “High-Frequency Trading: A Practical Guide to Algorithmic Strategies and Trading Systems” by Irene Aldridge provide valuable insights into high-frequency trading strategies. Another highly recommended book is “Algorithmic Trading: Winning Strategies and Their Rationale” by Ernie Chan, which offers practical advice and detailed explanations of various trading strategies.

Online courses also cover a wide range of topics related to algorithmic trading and quantitative trading finance. Specialized courses from various providers focus on algorithmic trading mechanisms and strategies, while webinars provide opportunities to learn from industry experts.

Moreover, participating in conferences like QuantCon can help traders network and stay updated on the latest developments in algorithmic trading. Online communities like QuantNet and Elite Trader facilitate discussions and knowledge exchange, further supporting your growth as an algo trader.

Key Factors to Consider When Choosing an Algo Trading Broker

When choosing a broker for automated trading, you shouldn’t just pick the first name you see. Your broker is the bridge between your algorithm and the markets, so consider the following factors before opening an account.

Fast Market Execution

Automated strategies live or die by how quickly your orders reach the market. Even a delay of a second can mean the difference between profit and loss, so always make an effort to improve trade execution speed.

Look for brokers with low‑latency infrastructure and direct connections to exchanges to minimise the time between signal and execution. Fast execution not only reduces price slippage but also helps your algorithm take advantage of fleeting opportunities.

Commission and Trading Costs

Every trade incurs costs. Spreads, commissions, and slippage might seem small on a single trade, but high‑frequency strategies place thousands of orders, so these expenses add up quickly. Compare the fee structures of different brokers. You’ll notice that some offer volume‑based discounts or tighter spreads for larger accounts. Keeping your trading costs down will improve your strategy’s net performance.

Algo Trading Tools and Features

A good broker should provide the tools your algorithm needs to thrive. Access to real‑time market data, historical price feeds for backtesting, robust APIs, and the ability to run custom scripts are essential. The platform should also integrate seamlessly with your trading software and offer reliable order routing. Without these features, even the best strategy will struggle to perform.

Virtual Private Server (VPS)

Hosting your trading platform on a VPS ensures that your algorithms run 24/7 without interruptions from internet outages or power failures. A dedicated trading VPS located near the exchange reduces latency and keeps your software connected even when your personal computer is offline. Many brokers offer free or discounted VPS services for active traders – a worthwhile perk that safeguards your strategy and helps it execute at top speed.

API Integration

Another crucial factor is the broker’s API integration. For your algorithm to communicate effectively with the broker, the trading software must connect directly to the broker’s network or exchange, enabling your strategy to place orders automatically.

When evaluating a broker, check whether they offer robust APIs (e.g., REST or FIX) with clear documentation. A well‑designed API should provide real‑time market data, order management and account information to your algorithm. Without stable API connectivity, your strategy may experience delays or errors.

Backtesting Software

It’s important to verify that the broker’s platform includes backtesting software. Testing your algorithm using historical data allows you to evaluate performance before risking real money. A good broker should provide high‑quality historical price feeds and a backtesting engine with metrics such as drawdowns, win rates, and Sharpe ratios.

When evaluating a broker’s backtesting capabilities, also look for flexible testing across multiple timeframes and assets, and the ability to adjust strategy parameters without rewriting code. Having these tools integrated into the platform saves you from exporting data to third‑party software and reduces the risk of errors.

Finally, backtesting goes hand in hand with paper trading. Many brokers offer demo accounts to simulate live trading; at Switch Markets, we provide a non‑expiring demo account so you can test your algorithms indefinitely without risking real capital. Starting with a demo account is a safe way to assess platform features and performance, and our unlimited demo ensures you have ample time to refine your strategy.

Summary - How to Start Algo Trading

In sum, algorithmic trading offers a systematic and disciplined approach to trading in financial markets, leveraging the power of technology to execute trades with speed and precision. Now, with over 70% of trading volume in global markets driven by algorithms, it’s clear that algorithmic trading is not just a trend but a cornerstone of modern financial markets. And, with the rise in AI applications, algo trading is likely to be adopted by many retail traders over the next few years.

By following the steps above, you can start the journey to become an algo trader. Is it going to be easy? No. You need to have the skills and the technological resources to succeed in algorithmic trading.

But success in algo trading is highly rewarding. Not only can it give you the satisfaction of consistently generating profits, but it can also provide you with the freedom and time to engage in other activities. Unlike manual trading, automated trading requires less time in front of the screen, less stress, and less human intervention. In other words, if it works, it’s a dream that comes true.

So, embrace the opportunities that algorithmic trading presents and take the first step towards mastering this exciting and dynamic field.

Frequently Asked Questions

Here are some of the common questions about algo trading:

Is algo trading really profitable?

Algo trading can be profitable, but it hinges on having programming and analytical skills as well as high-quality technology.. Without those, many traders end up losing money.

How important is backtesting in algorithmic trading?

Backtesting is super important in algorithmic trading because it lets you test strategies against historical data to spot weaknesses and make improvements before putting them to work in real markets. Do not avoid this step - It’s a key step to boost your chances of success.

What programming languages are commonly used in algo trading?

Python is the go-to language for algorithmic trading because it's easy to use and has tons of libraries. C, C++, and C# are also popular choices among traders. Additionally, MQL4 and MQL5 are used to program automated strategies on MetaTrader 4 and MetaTrader 5, PineScript for TradingView, and Microsoft C# for NinjaTrader.

How can I manage risk effectively in algorithmic trading?

To manage risk effectively in algorithmic trading, set clear risk parameters like stop-loss and take-profit levels, and consider using tools to automate position size calculations. This way, you'll optimize your position sizing and protect your capital. Lastly, use a VPS to ensure high-speed execution and recursion in slippage.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.