How to Build a Trading Bot Without Coding on Switch Markets

One of the first things a trader gets to realize is that although trading is exciting, it’s also a grind. Watching charts all day? Not ideal, especially if you’re juggling a 9-to-5, family, or, let’s be honest, just trying to live your life. That’s where AI trading bots come in. AI trading bots offer many advantages, such as increased efficiency, speed, accuracy, and 24/7 operation. Best of all, now you can build one without writing a single line of code.

Now, it's not just a tool for large investment banks, hedge funds, and programmers; anyone can automate their trading, and quite easily.

In this article, you’ll learn how to automate your trading strategies in just a few clicks with Switch Markets’ new tool AlgoBuilder. Oh, and did we mention it’s free?

Let’s go to it.

What is an AI Trading Bot?

An AI trading bot is basically a software program that executes trades automatically based on a predefined strategy.

The “AI” part means it uses artificial intelligence, machine learning, and smart algorithms either to create the trading bot, analyze the market, or recognize patterns.

These bots can work on various financial markets, including forex, stocks, indices, crypto, and commodities. Depending on how advanced the algorithm is, some bots can even take in fundamental data or market sentiment from the news and adjust their behavior accordingly. However, most AI trading bots analyze economic technical indicators, different timings, chart patterns, and spreads between different markets or instruments.

Think of it like this: instead of manually clicking “buy” or “sell” every time you see a setup, the bot does it for you. 24/7. No emotions. No second-guessing. It just executes trades based on algorithmic trading strategies. And because bots don’t get tired, distracted, or stressed, they can maintain consistency over time, which is something many human traders struggle with. From this point on, all you have to do is to come up with a profitable strategy, backtest it, and then apply it in the live markets.

How Does an AI Algorithmic Trading Bot Work?

A trading bot connects to your brokerage account and follows a set of rules to trade automatically. These rules can be as simple as “buy when the RSI drops below 30” or more complex, involving moving averages, price action patterns, or even news-based triggers.

Here’s a quick breakdown:

- Market Scanning: The bot constantly scans the market for your chosen conditions.

- Signal Generation: When it finds a match, it triggers a buy/sell signal.

- Trade Execution: It places the trade instantly based on your preset risk settings, incorporating risk management techniques such as stop-loss orders and position sizing.

- Monitoring & Exiting: It can monitor trades, set stop-losses, take profits, and even trail stops—completely hands-free.

As mentioned earlier, some bots even evolve using AI, meaning they can “learn” what works and improve their trading performance over time.

Others include features like sentiment analysis or pattern recognition using real-time market data. With the right setup, a bot can adapt to different market environments, ranging from trend following during strong directional moves to mean reversion in ranging conditions. One thing that is highly recommended is to use a VPS, which ensures that your connection is protected and safe, market execution is much faster, and you can significantly reduce price slippage.

How to Get an AI Trading Bot?

At Switch Markets, we have launched a feature called Algo Builder, and we’re giving it away for free to anyone who opens a trading account and deposits just $50. That’s it. No hidden fees. No monthly charges. Just a super powerful AI trading bot builder in your hands, even if you’ve never coded a thing in your life.

Here’s what you need to do:

- Go to Switch Markets and open an account.

- Deposit $50 or more to activate your access.

- Start using the Algo Builder—no software installs, no setup headaches.

Once your exchange account is funded, you’ll find the Algo Builder right inside the dashboard. Click, build, test, go. Easy. And the best part? You’re not locked into a particular strategy. You can build multiple bots, test different timeframes, and refine your setups—all in one place.

This kind of access to smart automation has traditionally been reserved for hedge funds or experienced coders. Now it’s in your hands.

How to Create a Trading Bot Without Coding on Switch Markets

We’ve come to meet the potatoes of this article: how to create your own custom trading bot without writing a single line of code. Establishing the necessary infrastructure is crucial, which includes setting up a server or cloud platform and ensuring all software dependencies are properly configured. To get us started, here’s an overview of how the whole process looks like:

- Define your trading strategy

- Verify and refine the rules

- Generate the code

- Backtest your trading bot

- Deploy your trading bot

Now, let’s carefully go over all the step-by-step process in detail.

Step 1: Define your strategy

Unless you are paying for a trading bot that has been developed by other people, the first step to creating a trading bot is being clear on your trading strategy. If your strategy cannot be stated in a set of rules, you can’t automate it with a trading bot.

The work of a trading bot is not just to go into the market and use its intuition to place trades; it simply executes based on the custom instructions you have given to it.

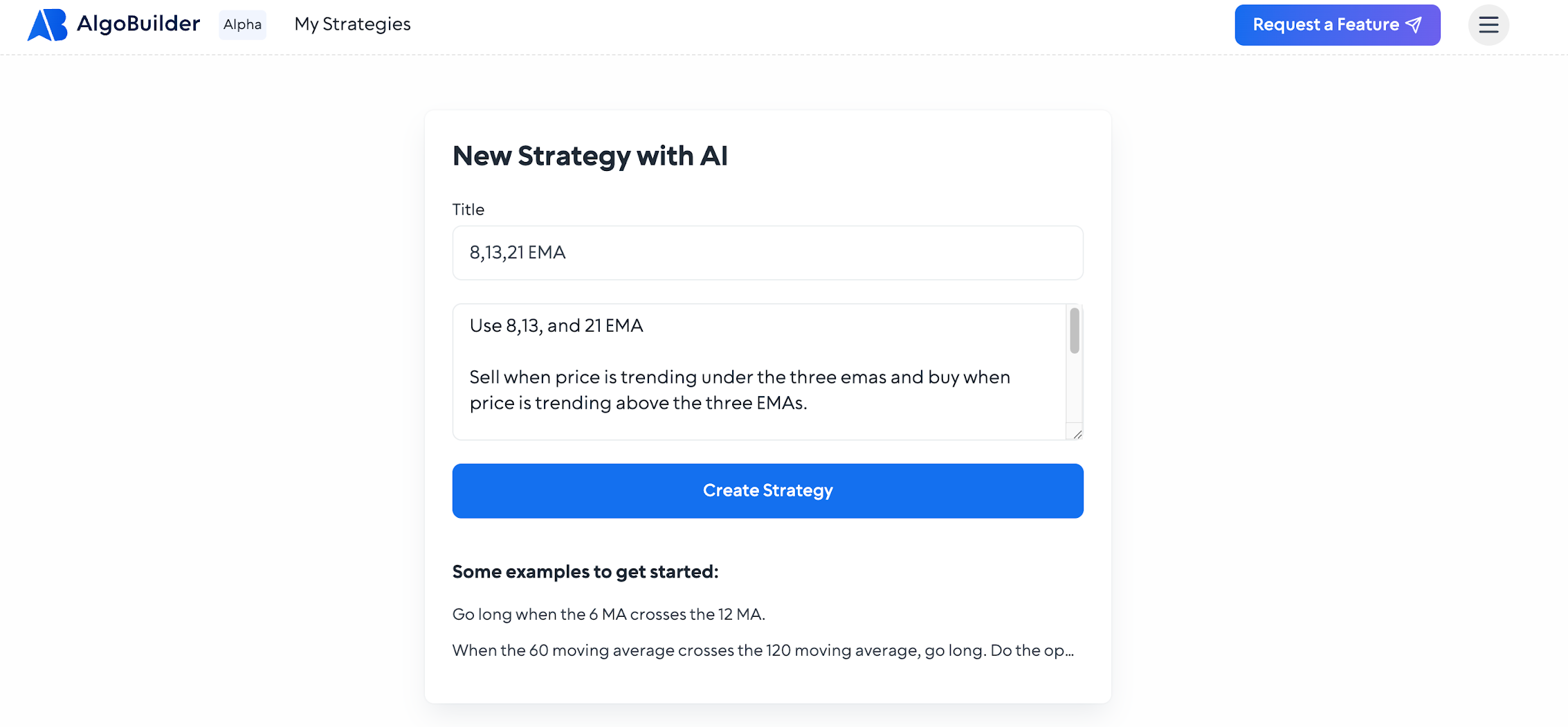

So, do a little exercise: write your entire trading strategy into a few sentences, considering your goals and risk tolerance.

Once this is done, go ahead and put the statement into the text field on the page as shown below, give your strategy a name, and hit the “Create Strategy” button to proceed to the next step.

If you find out you couldn’t properly articulate your strategy into a few sentences, chances are that your trading strategy is mainly discretionary and not mechanical enough. Knowing that, you may want to make it as mechanical as possible before moving on.

Step 2: Verify and Refine the Rules

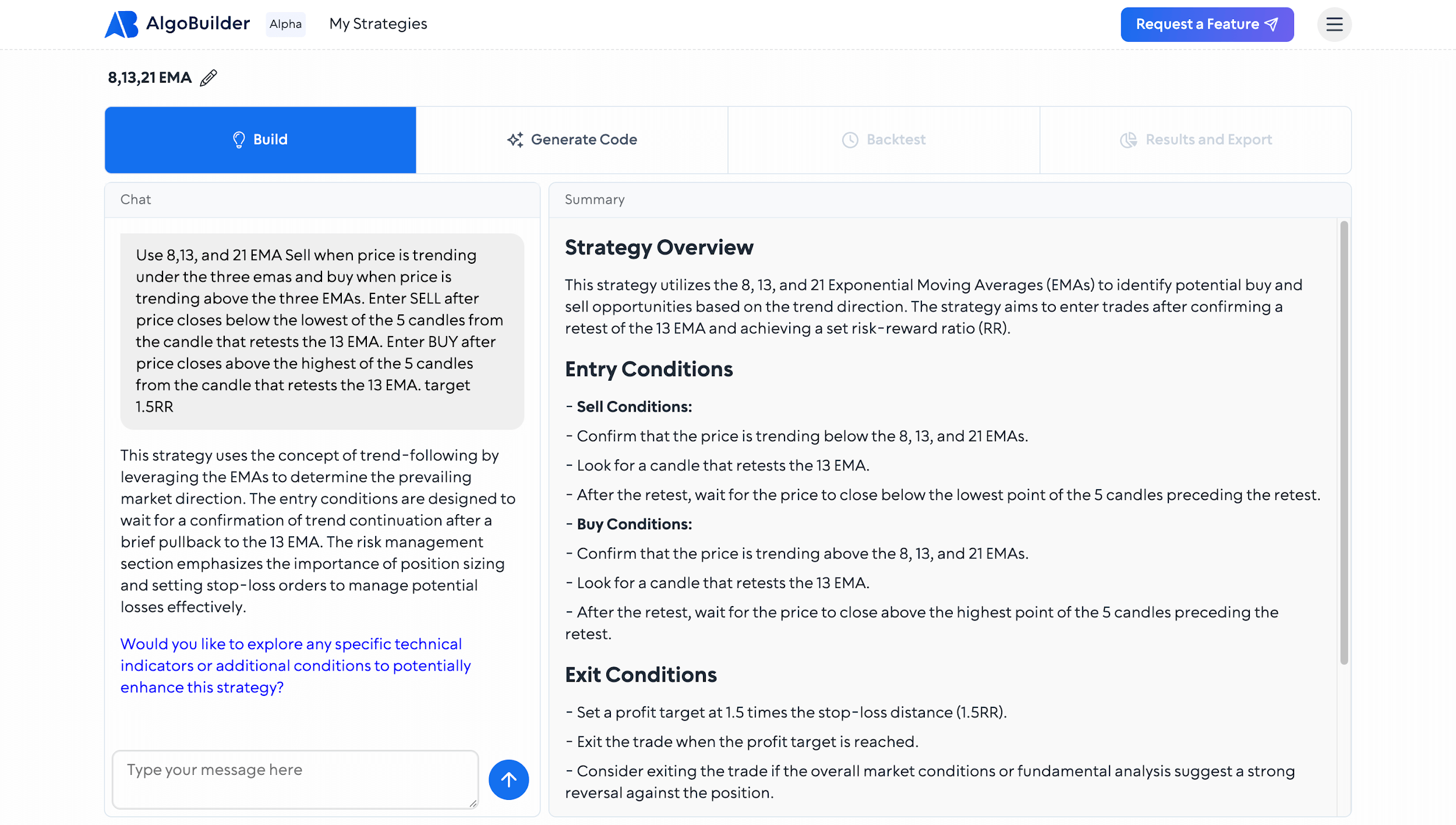

Once you are done with the first step, our AI system will automatically process the information you have given and state all of your trading rules in the clearest way possible.

Since this step comes just before our trading builder starts writing the codes, it’s important to carefully review this output and ensure it completely and accurately represents your trading strategy, incorporating technical analysis where necessary.

In a very rare case where there are a few mistakes or you forgot to add other important information into your strategy, you can make use of the text field at the bottom left of the page to edit and refine the outputs.

If you are satisfied with the overview, it’s time to go ahead with the next step. Simply click the “generate code” tab just above the overview.

Step 3: Generate Code

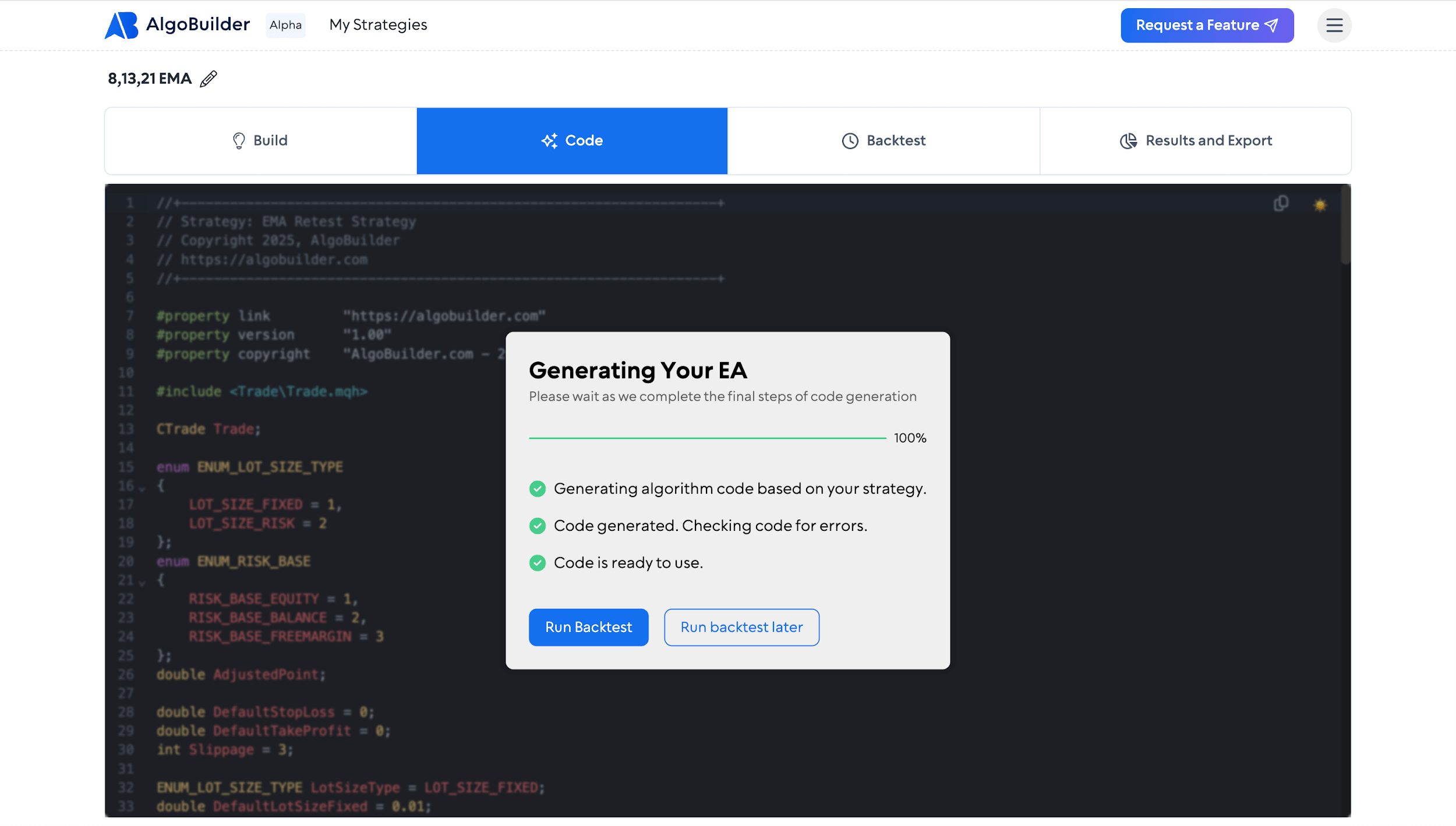

This process is effortless and straight to the point.

Once you click the “generate code” button, our advanced algorithm spurs into action, converting your strategy into effective codes. This process turns your strategy rules into a Python script for a trading bot.

Just allow it to do its thing. Once the code is ready, you have an option to either go straight to backtesting your strategy or review the code.

If you’re not code-savvy, don’t worry. Just go ahead with the next step and start backtesting. However, if you are used to writing code, you may want to look through the code to familiarize yourself with what’s going on behind the scenes of your newly built free AI trading bot.

Step 4: Backtest Your Trading Bot

At this point, it is safe to say that your trading bot is ready to go. But before you start using it on your live account, why not backtest it with historical data?

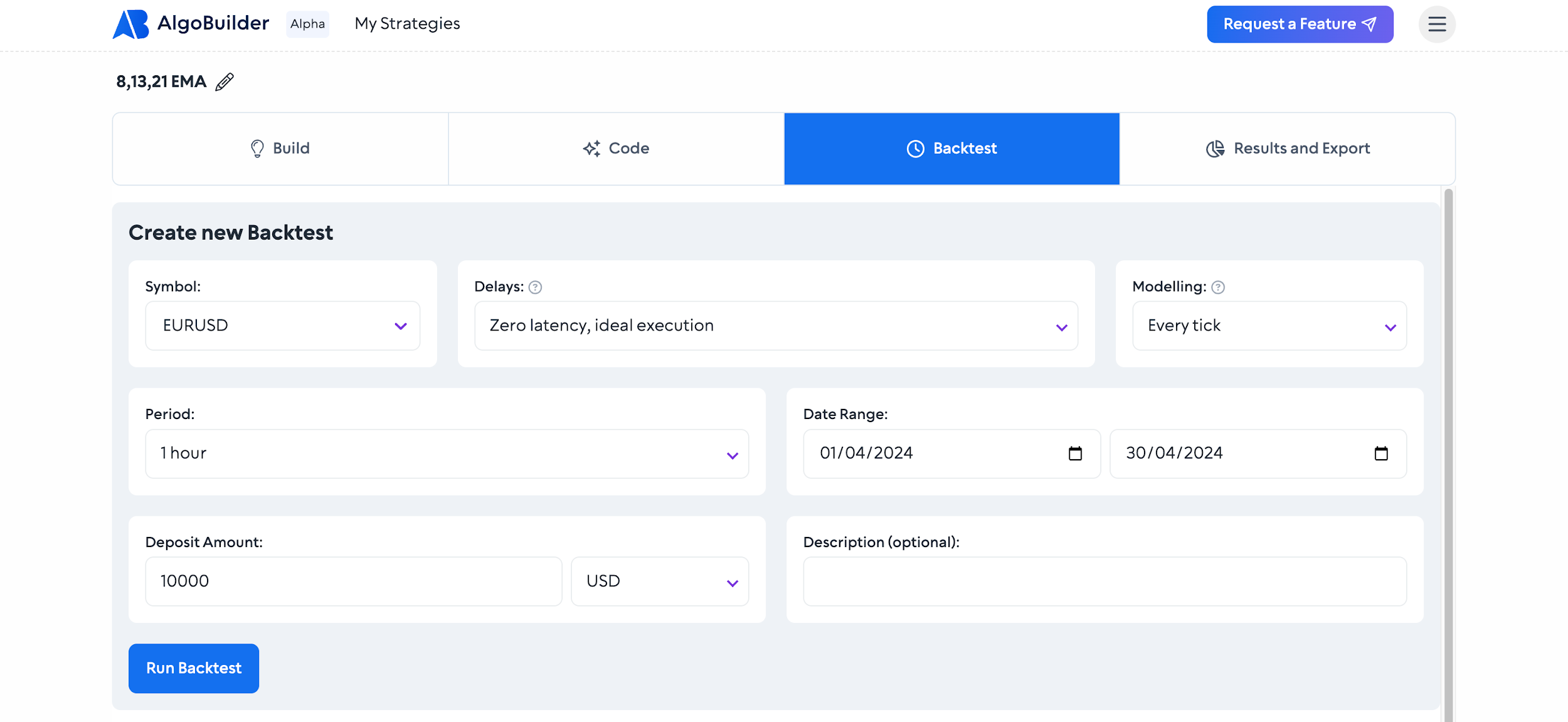

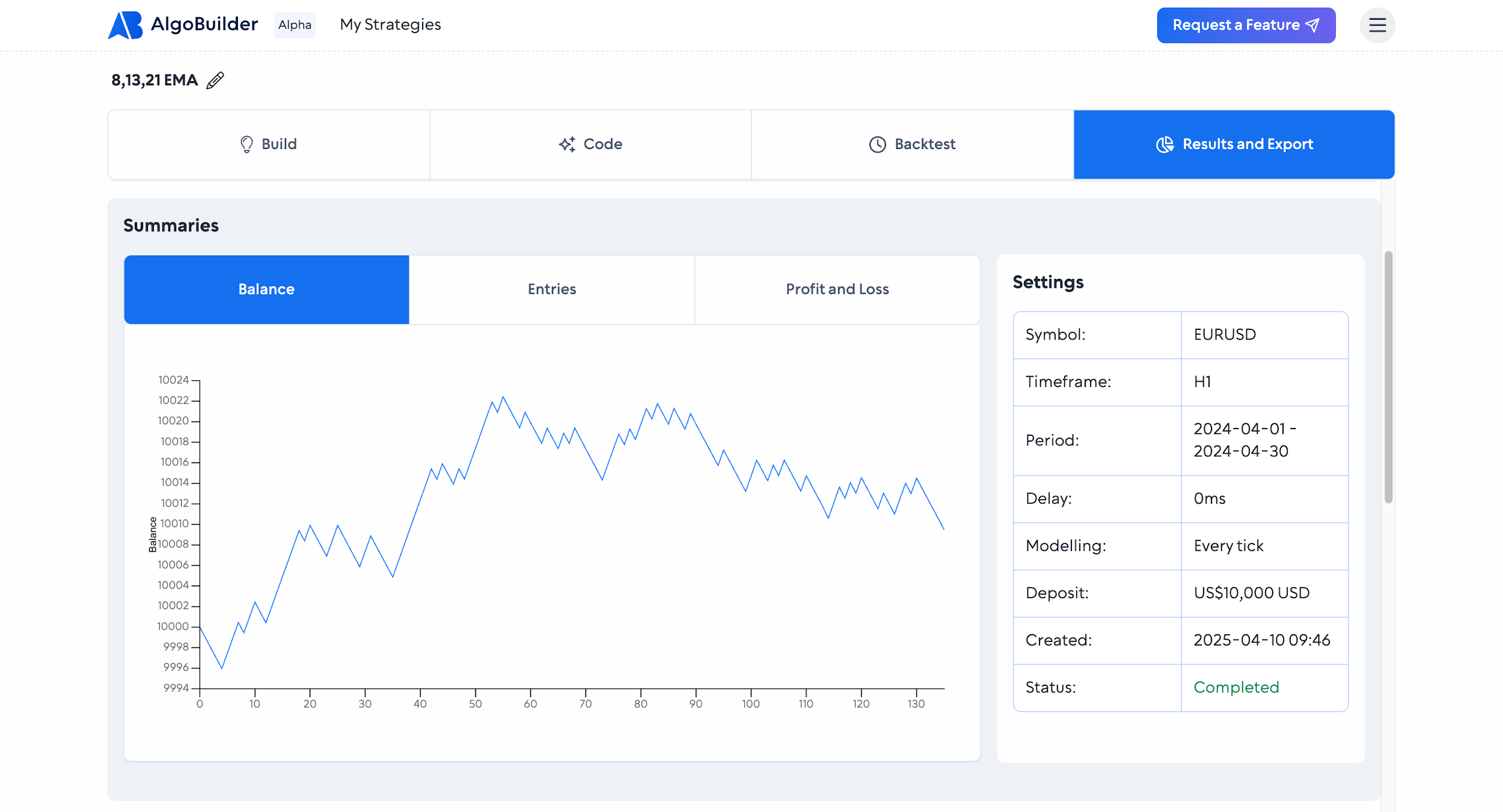

Our AlgoBuilder has a fully customizable in-built backtesting software that can quickly let you know how your trading bot can perform. With a plethora of price data from 2021 to date, you can choose to test your trading bot in different market conditions, timeframes, etc.

Here’s what the interface looks like:

Once you are done setting your backtesting parameters, hit the “Run backtest” button and wait for your result. In a few seconds, you should have a thorough breakdown of the performance of your trading bot as shown below.

Once you are satisfied with the result, you can go ahead and deploy your trading bot. However, if the result is not satisfying, there are a few things you can do.

For instance, you can go back to the “backtesting” tab and test different parameters like timeframe and price data. It is not unlikely that certain strategies perform better on certain timeframes or market conditions than others. So, don’t just throw away the strategy without checking these out.

If you’ve tried everything and the performance is still poor, maybe that’s some good news. You have successfully avoided taking unnecessary losses. It’s now time to refine the strategy or completely ditch it for a new one.

Step 5: Deploy your Trading Bot

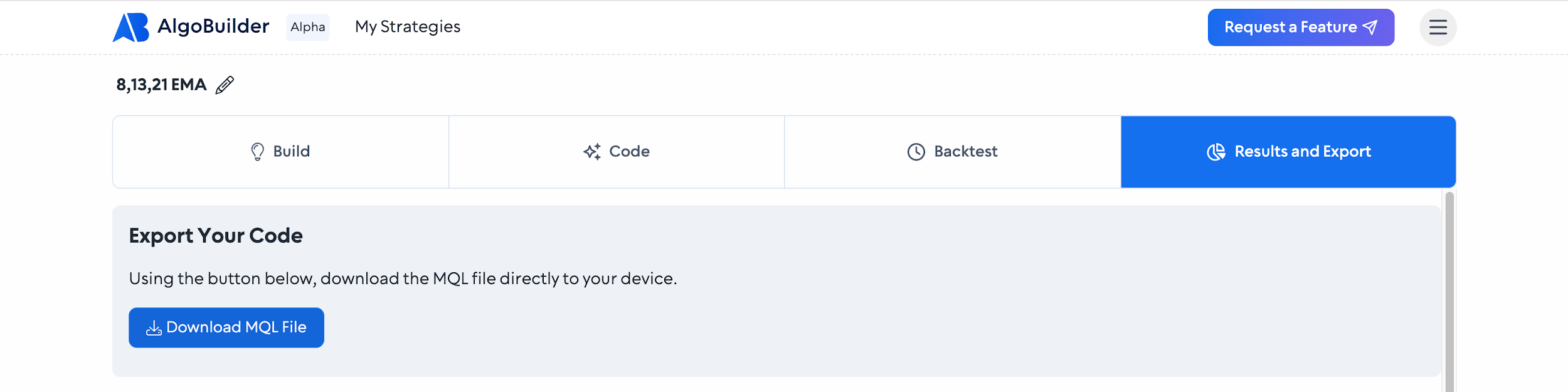

Finally, you’ve gone through all the steps, and your AI trading bot looks really promising. It’s time for you to deploy it on your preferred trading software and transition to live trading.

To do this, all you have to do is hit the “Download MQL5 file.” Once it’s downloaded, you can import this into your MT5 Platform and start trading. To learn more about this process, you can visit our guide on how to connect your MQL5 account to MetaTrader4/5. Once this is done, you can run your automated trading strategy on MT4/5. From this point, all that is left is to monitor your account and track your trades with our built-in application, TrackATrader.

But before you go, we have some parting shots for you below.

Bonus Tips for Success with AI Trading Bots

Want to boost your odds of success? Monitoring key performance metrics, such as win rate, is crucial. Here are some tried-and-true tips:

1. Start Small and Scale Up

Begin with a demo account or a small real account. Let your bot prove itself before you increase the stakes. Gather data, track performance, and make informed decisions based on actual trading results.

2. Keep It Simple

Don’t overcomplicate your strategy. Simple, robust logic tends to perform better over time. Focus on repeatable patterns, clear entries/exits, and easy-to-follow risk management, including position sizing.

3. Monitor Performance

Even if it’s automated, check in regularly. Watch out for changing market conditions that might affect your bot’s logic. Regular reviews ensure your strategy stays relevant.

4. Backtest Often

Markets evolve. Periodically retest and refine your bot to keep it sharp. Use updated past data to test how your strategy holds up across volatility spikes, news events, and trend shifts.

5. Avoid the “Set and Forget” Trap

Bots are tools, not magic money machines. Be strategic, stay involved, and address any technical issues that may arise. Make adjustments, stay educated, and treat your bot like a business, not a slot machine.

In a Nutshell - How to Automate Your Trading with a Free AI Trading Bot

Here’s a quick summary on how you can automate your trading with Switch Markets' AI trading bot:

Let’s be real, manually trading is exhausting. But now, with AI and no-code tools like Algo Builder, you don’t need to spend years learning to program or hire developers.

If you’re interested in chasing financial freedom, passive income, or just want to stop missing trades while you sleep, building a trading bot has never been easier or cheaper.

With Switch Markets’ free AI trading bot builder, you can automate your trades, simplify your strategy, and take control of your time and more money.

To start, open your account, drop that $50, and start building your first bot today.

FAQs

Now that you know how to build and deploy your own trading bot, you probably have a few lingering questions. Let’s tackle the most common ones, including the role of algo trading in automated trading strategies, to make sure you’re fully equipped to get started with confidence.

Are AI trading bots profitable?

They can be if they are built well. The real edge comes from combining a solid strategy with proper risk management techniques.

How much does an AI trading bot cost?

Normally, most companies charge around $20-$150 per month for using an AI trading bot. With Switch Markets? Zero. Nada. Zilch. It’s completely free when you deposit just $50.

Are AI trading bots legit?

Yes, but it depends on the platform. Switch Markets is a reputable and regulated broker, and its Algo Builder is a secure tool integrated directly into your trading dashboard, utilizing the exchange API for seamless and reliable trading. You may want to avoid random bots from Telegram or YouTube with no proof or regulation.

How can you get a free AI trading bot?

Just open an account on Switch Markets and deposit $50. Once you do, you’ll instantly unlock the Algo Builder, which lets you build and run trading bots without coding for free, including paper trading simulations using API keys.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.