8 CFD Trading Tips You Must Know About

- 1. Choose a Broker that Aligns with Your Trading Goals and Preferences

- 2. Learn About CFDs and How They Work

- 3. Always Know CFD Rollover Expiration Dates

- 4. Understand Leverage and How to Use It Wisely

- 5. Learn How to Use Swap Rates to Your Benefit

- 6. Find the Ideal Position Size for Optimal Results

- 7. Get Familiar with the Broker’s Tools and Trading Platform

- 8. Always Track and Analyze Your Trades

CFD trading is an exciting form of trading that is packed with opportunities, but only if you know what you’re doing. Many traders dive in headfirst, chasing profits, only to realize that there’s more to this game than just clicking “buy” and “sell.”

If you want to stay ahead of the curve, you need to arm yourself with the right knowledge and tools. And that’s exactly what this guide is about.

On this page, we’re breaking down 8 best CFD trading strategies and tips that can make all the difference in your trading journey. These insights will aid you while managing risk; they will help you avoid costly mistakes and maximize your trading opportunities when trading the CFD market.

1. Choose a Broker that Aligns with Your Trading Goals and Preferences

The first, and perhaps the most important of all, is to find a good place to manage your trades. Many traders, especially new ones, completely leave out the place of conducting due diligence when choosing a broker.

You see, people generally say things like “In life, it’s the little things that count.” This can’t be more true when it comes to CFD and forex trading. Choosing a brokerage firm that aligns with your trading goal requires you to put a lot of things under consideration.

For instance, if you are scalping or day trading, you have no business trading with a brokerage firm that doesn’t offer an ECN or zero spread trading accounts. Once this is ignored, your chances of being profitable have been drastically reduced.

A swing or position trader’s nightmare is a brokerage firm that charges outrageous swap (overnight) fees, or one that does not provide dividend payments on share holdings. Such a move is bad for their trading success on so many levels.

Other crucial things to check include regulation, spreads and fees, the trading platforms, the tools provided by the broker, and customer support.

All of these can be extremely important to your success as a trader. Therefore, insist on choosing a brokerage firm that provides you with a trading environment that supports your edge.

2. Learn About CFDs and How They Work

If you're going to trade CFDs, it only makes sense that you fully understand what they are and how they work.

Let’s break it down.

CFD stands for Contract for Difference, which simply means that when you trade a CFD, you’re not actually buying or selling the underlying asset. Instead, you’re entering into a contract with your broker to speculate on the price movement of that asset.

Say you’re trading gold CFDs. You don’t actually own any physical gold bars stacked in a vault somewhere. Instead, you profit (or lose) based on whether the price of gold moves in your predicted direction.

The beauty of CFDs is that they allow you to trade a wide range of financial markets—including currency pairs, stocks, indices, commodities, and even cryptocurrencies—without having to own the actual assets. Plus, you can trade in both directions. Whether the market is going up or down, you can still make money.

Sounds great, right? Well, as with everything in trading, there’s a catch.

Because CFDs operate on leverage, your potential profits are magnified—but so are your losses. This is why understanding how CFDs work is non-negotiable before you start trading. For that reason, it is advisable to practice on a demonstration account before you risk real money. With a demo account, you can learn how CFD trading works and what the right leverage is that works best for you.

3. Always Know CFD Rollover Expiration Dates

Imagine this: You’ve analyzed the market, placed your trade, and everything is going exactly as planned. Then, out of nowhere, your position closes automatically, and you’re left wondering what just happened. Well, it happened to me. And trust me, losing a trade because of a CFD rollover can be painful.

Here’s the deal: Certain CFD products, especially futures-based CFDs like indices and commodities, come with an expiration date. When that date arrives, the contract either expires or gets rolled over to a new one, depending on how your broker handles it.

If your broker automatically rolls over the contract, you might notice an adjustment in price due to the difference between the old and new contracts. But if they don’t? Your position will be closed, whether you were ready for it or not.

So, what’s the smart move? Always check the rollover dates for any CFDs you’re trading. A quick visit to your broker’s contract specifications or trading calendar can save you from unexpected surprises. If necessary, contact the support team for more information.

At the end of the day, staying informed about CFD expiration dates is just another way to stay in control of your trades. And in trading, control is everything.

4. Understand Leverage and How to Use It Wisely

One of the things that makes trading CFDs the talk of the town is the leverage.

It’s no news that everyone trades to make money, and since the use of leverage promises to make you even more money, it only makes sense that traders love it.

Leverage comes in different types. While there are 1:10, 1:100, etc., Switch Markets offers traders leverage up to 1:1000, which means that your $200 deposit can give you up to $200,000 in purchasing power. Moreover, Switch Markets also offers dynamic leverage, which is a type of leverage that can automatically be adjusted based on your position.

Amazing right? Yes, it is. However, leverage also comes with a significant risk, as things can get ugly really fast if you don’t know how to use leverage wisely. You can lose your money to the market just as quickly when your leveraged position goes against you. This is why a good understanding of risk management helps. For that matter, it is also extremely important to use a leverage calculator such as our Forex Margin Calculator or our Risk Management EA tool that can help you manage your risk effectively.

So, unless you fully understand how leverage works and how to strategically use it, you might want to scale in slowly.

5. Learn How to Use Swap Rates to Your Benefit

Understanding how swap rates can impact profitability can be the difference between an average trader and a smart trader.

So, what exactly is a swap rate?

A swap is the interest you either pay or earn for holding a CFD position overnight. This happens because every trade involves borrowing one currency or one asset to buy another.

If the interest rate on the currency you’re buying is higher than the one you’re selling, congratulations—you get paid a swap. But if it’s the other way around, you’ll be the one paying the swap fee.

Swap rates are determined by interbank interest rates and can change depending on market conditions. Plus, on certain days, like Wednesdays, you might even see a triple swap charge to account for the weekend rollover.

Now, how do you turn this into an advantage?

If you're a swing trader or someone who holds positions for days or weeks, look for positive swap opportunities—trades where you earn a swap instead of paying it. This way, you’re not just making money from price movements, but also from the swap payments credited to your account daily. This is known as the carry trade strategy.

On the flip side, if you’re frequently paying high swap rates, you might want to reconsider your holding time. For that purpose, you can use our Forex Swap calculator, which will help you determine if the transaction is worth holding for the long term.

Bottom line? Don’t ignore swap rates. They can either be an unnecessary cost or a hidden income stream—it all depends on how you use them.

6. Find the Ideal Position Size for Optimal Results

It’s finance 101 to make a budget before spending your money or even running a business. Position sizing is how we “budget” when it comes to trading CFDs.

Position sizing allows you to predetermine how much of your capital goes to a single trade or a series of trades. This way, you know precisely how much you stand to lose should the price go against you. And in trading, finding the ideal position size can be a challenging task.

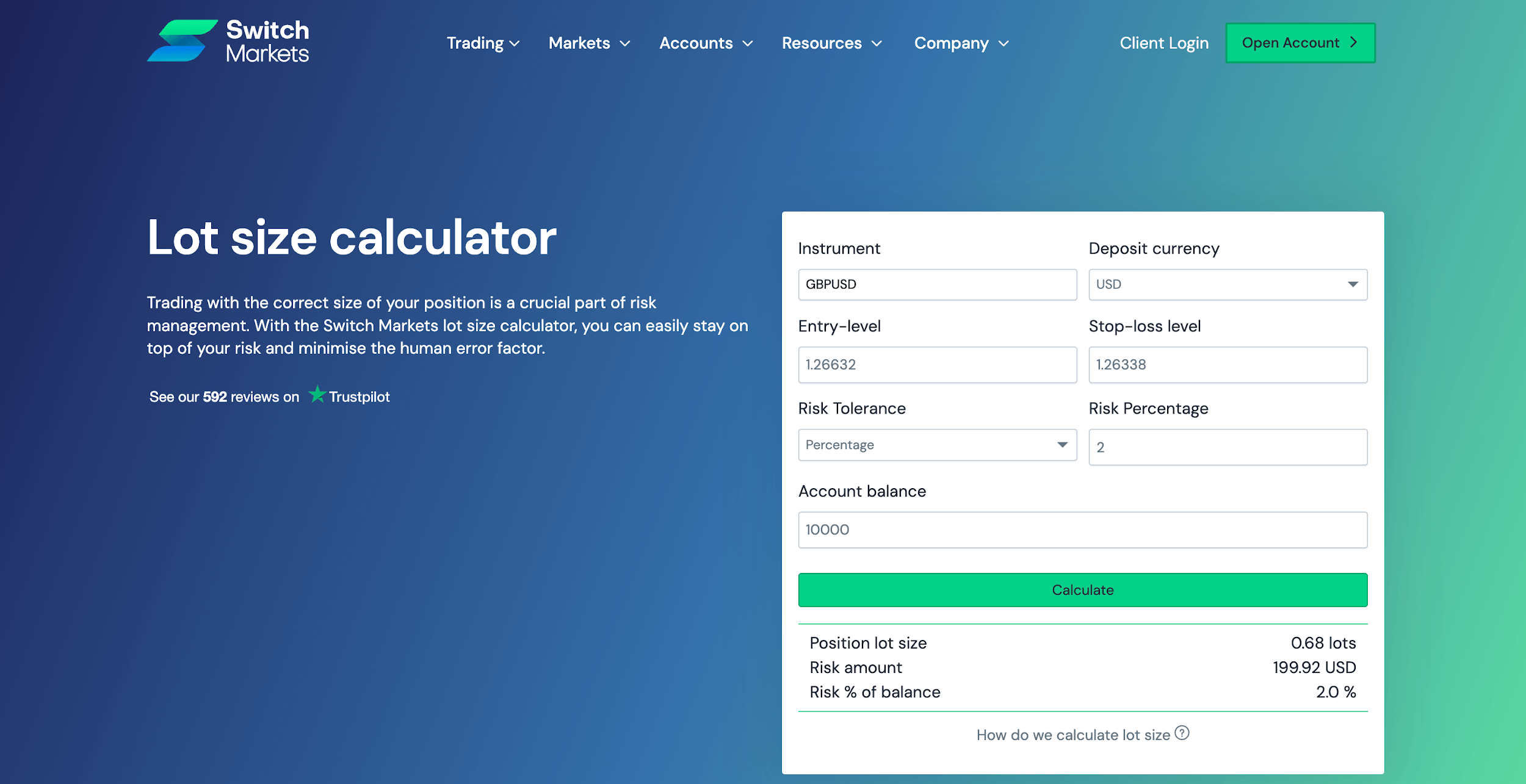

Let’s say you have $10,000 and you wish to risk just 2% of it on a GBP/USD setup that you just analyzed. With Switch Markets, all you have to do is plug in the trade details on our Lot Size calculator, and in no time, you should have something like this:

After you’ve gotten the appropriate lot size, you can place your trade with that amount, set your take profit and stop loss, and go to rest. To learn more, you can visit our guide on how to use a position size calculator.

7. Get Familiar with the Broker’s Tools and Trading Platform

A lot of brokers have generously made several trading tools available to their traders. All you have to do is start using them.

Switch Markets, for instance, provides a suite of tools designed to enhance your trading experience and help you make better decisions. Let’s take a look at some of them:

- Economic Calendar that helps you keep track of scheduled economic releases, central bank decisions, and geopolitical developments that could impact your trades.

- Lot Size Calculator helps you to determine the perfect position size for each trade based on your account balance and risk percentage. This tool ensures you’re not overleveraging your trades.

- Swap Calculator helps you calculate the swap fees or credits you’ll incur so you can factor them into your trading strategy.

- Track a Trader is a tool that allows you to track performance metrics, identify strengths and weaknesses, and optimize your strategy over time.

- Algo Builder is a trading bot that helps you to easily automate your trading strategies without having to know coding.

Remember: not all trading platforms are created equal. Choose the one that works for you and stick to it.

8. Always Track and Analyze Your Trades

As the saying goes, “you can’t get better at what you don’t track.”

If you've read this, it shows that you really want to get better at your trading. One habit that is guaranteed to put you years ahead of unprofitable traders is journaling and tracking your trades.

When you start tracking your trades, you’ll begin to see patterns in how you trade. This way, you can easily capture what you’re doing wrong and what you’re doing right.

The goal is to eliminate what’s not working and do more of what works.

Traders who regularly track their trades vary in how they go about the process. Some keep a manual journal, while others use Excel spreadsheets or even some fancy and expensive software. These methods have their pros and cons, but just find the one that works for you and stick to it.

By the way, if you’re already trading with Switch Markets, you automatically are entitled to our tracking software, Track a Trader. You should check it out if you want to level up your trading as soon as possible.

By following these eight essential tips, you’re already putting yourself ahead of many traders who overlook the fundamentals. Whether it’s choosing the right broker, mastering leverage, using swap rates to your advantage, or tracking your trades, each step plays a crucial role in your long-term success.

At the end of the day, consistency is key. The more effort you put into learning, refining your strategy, and using the tools available to you, the more control you’ll have over your trades.

So, take these insights, apply them, and trade smarter. The CFD market is full of opportunities—it’s up to you to make the most of them.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.