ECN vs. Standard Account - What Are the Differences and How to Choose?

Traders have the option of choosing different types of trading accounts while opening a forex/CFD trading account.

Although a lot of traders choose either an ECN account or a standard account, many of them don’t know for sure which of those accounts is actually suitable for them.

This short guide will cover the differences between an ECN and a standard account and how to choose the right one for your trading. So, let’s get to it.

What Is an ECN Account?

An ECN (Electronic Communication Network) account connects traders directly with liquidity providers, such as banks and other market participants. This means trades are executed without any dealing desk intervention, offering tighter spreads and greater transparency.

With an ECN account, you pay a fixed commission on trades, and the spreads are as low as the market can offer. For instance, on the Switch Markets ECN account, you can get spreads as low as 0.0 on the Pro account type. In other words, with an ECN account, spreads are very competitive and enable traders to easily get in and out of positions.

For that reason, ECN accounts are particularly popular among day traders and scalpers, who need faster trade execution. They are also used by algo traders who rely on high-frequency strategies.

What’s more, the transparency of an ECN account also helps traders understand their exact costs, avoiding surprises that often occur with other account types. Unlike a Standard account, an ECN account enables traders to know their exact trading costs. On Switch Markets, traders get a fixed fee per transaction of $3.50, which is the commission paid for each time you enter or exit a 1 lot trade.

Key Features of an ECN Account

Here’s a quick rundown of the key features of an ECN account:

- Direct market access with no dealing desk.

- Raw spreads start from as low as 0.0 pips.

- Transparent, fixed commission fees per transaction.

- Faster trade execution.

- Ideal for scalpers, day traders, algorithmic traders, and those trading during volatile market conditions.

What Is a Standard Account?

A Standard account, on the other hand, involves spreads that include a markup, making them slightly wider compared to ECN accounts. These accounts are simpler in structure as they don’t charge a separate commission; instead, the broker's fee is embedded in the spread.

Standard accounts offer an excellent entry point if you want to start with a straightforward cost model and a more predictable trading experience. This way, there’s no need to calculate separate commission fees, hence making the overall trading process more user-friendly.

Key Features of a Standard Account

Here are some of the major features of a standard account:

- Spread includes a broker’s markup.

- No additional commission fees.

- Easier cost structure for beginner traders.

- Suitable for casual traders and those who prefer predictable costs.

Comparing ECN and Standard Accounts

Here’s a quick comparison between an ECN and a Standard account on Switch Markets:

Why Choose an ECN Account?

If you value transparency and want to know the exact fee per transaction, an ECN account is the way to go.

Many traders are pleasantly surprised to see raw spreads as low as 0.0 pips. Usually, ECN brokers like Switch Markets are able to offer raw spreads because they make their money by charging you a commission based on your trade size.

This account type is perfect for traders who need precision, especially in volatile markets. For instance, scalpers and algorithmic traders benefit from faster execution speeds and raw spreads. In addition to a Free VPS, which is provided by Switch Markets, an ECN provides the ideal trading environment for short-term traders.

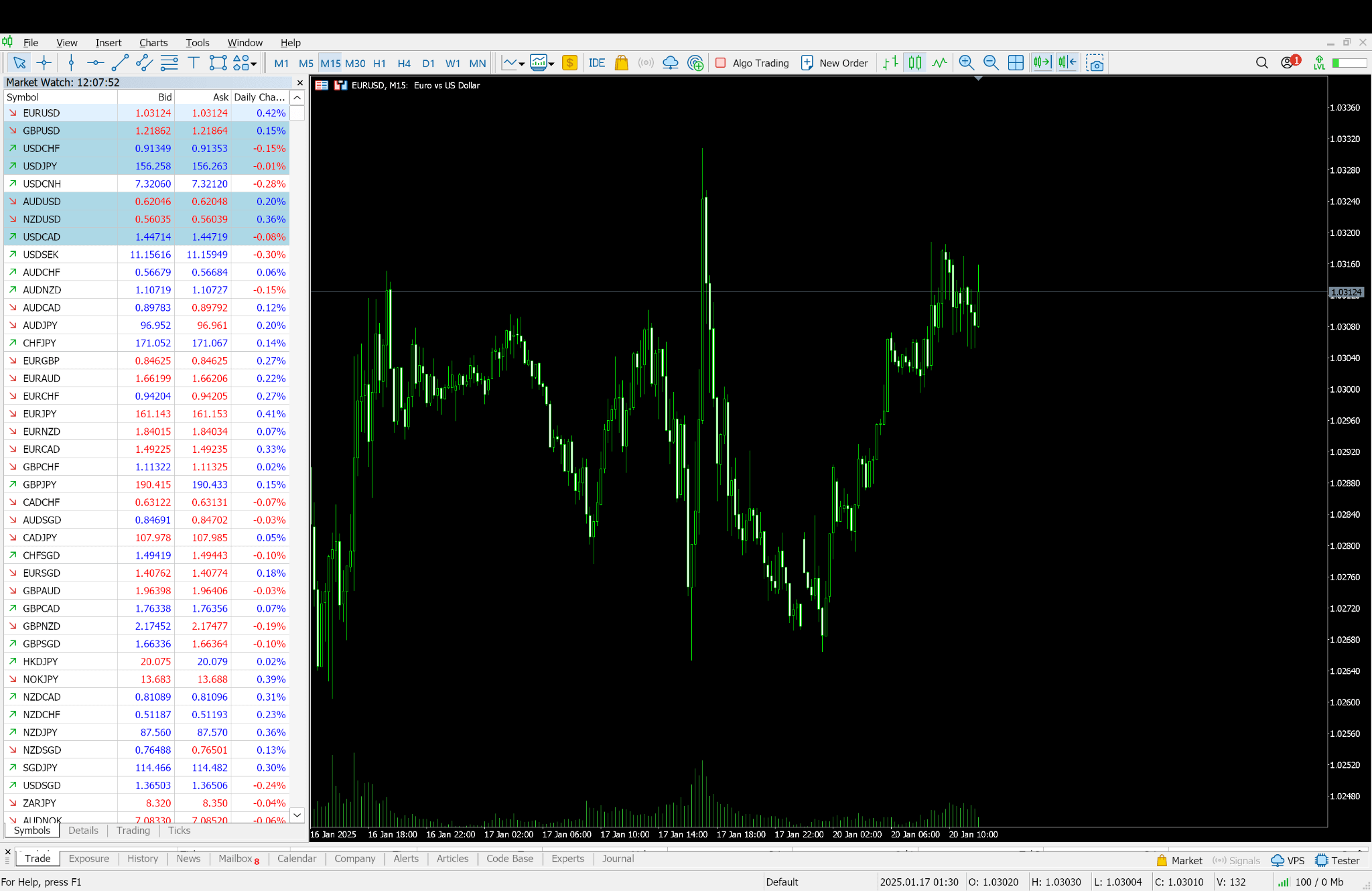

As you can see in the image below, spreads on an ECN account are extremely competitive, offering traders the flexibility to get in and out of positions without any consideration of the spread.

Bear in mind that many brokers usually require a significantly higher initial deposit before traders can access an ECN trading account.

However, the $50 minimum deposit for ECN accounts at Switch Markets is much lower than what most brokers offer, making it accessible to a wide range of traders.

Why Choose a Standard Account?

Not all trading strategies require you to have a very tight spread before you can be consistently profitable. So, if you’re just starting out or prefer simplicity, a Standard account can be a great choice. Also, a Standard account can be the ideal choice for position or swing traders who normally hold positions for days, weeks, and months.

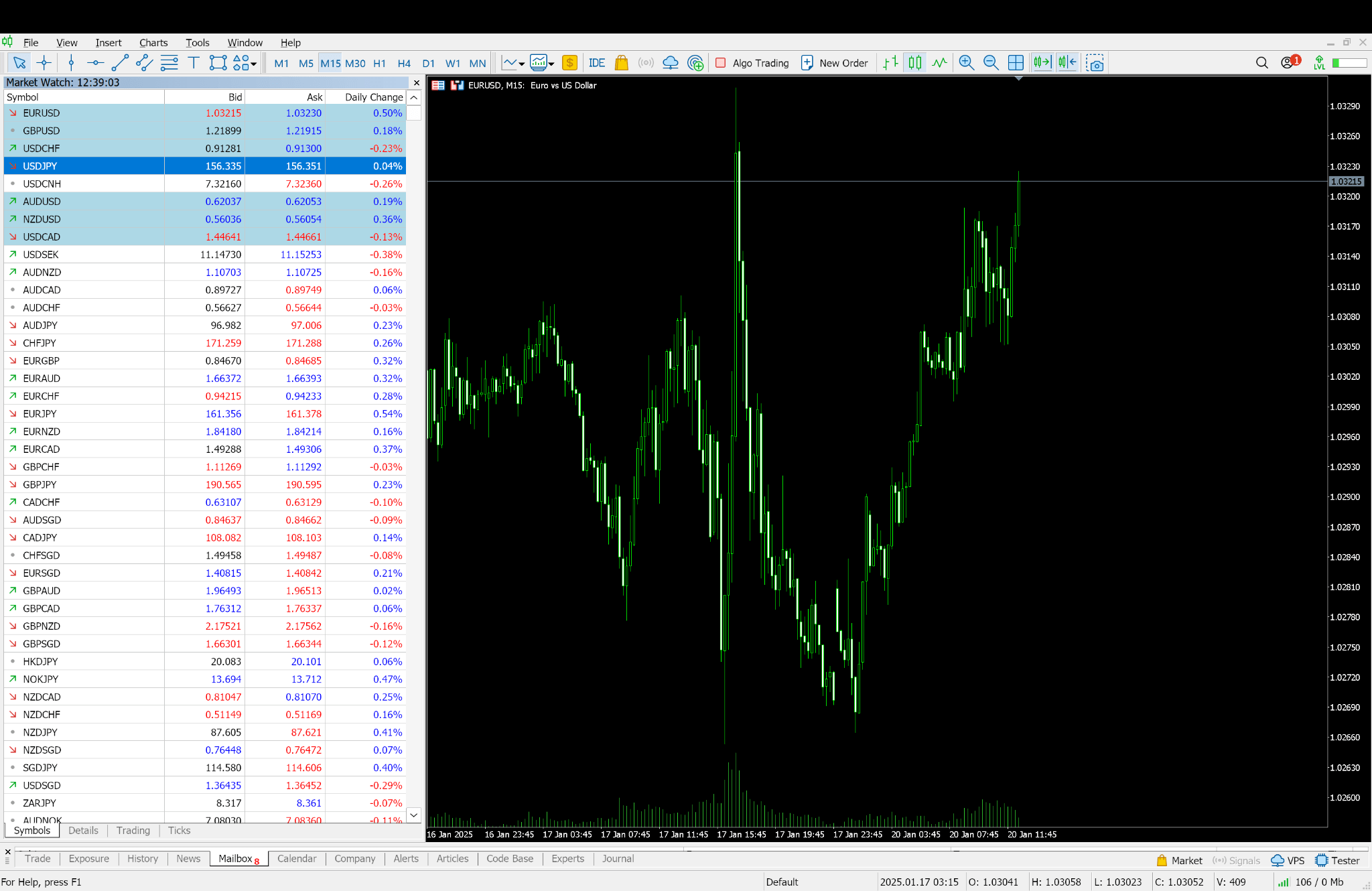

As seen in the image below, spreads on a Standard account are slightly higher than on an ECN account; however, with a Standard account, traders are not required to pay a fixed commission every time they enter a trade.

With no separate commission, the costs are embedded in the spread, making it easier to calculate your trading expenses. This account is ideal for traders who value predictability and don’t trade frequently.

In sum, a Standard account is particularly useful for those who prioritize a more straightforward approach.

How to Choose the Right Trading Account

Here are some practical steps to guide your decision-making process:

- Consider Your Trading Style: Are you a scalper or an active trader? Go with an ECN account. Prefer swing trades or less frequent activity? A Standard account might suit you better.

- Analyze Your Budget: Both accounts at Switch Markets have a minimum deposit of $50, but think about the cost structure. ECN accounts may appear more cost-effective for active traders in the long run.

- Evaluate Market Conditions: If you’re trading in highly volatile markets, ECN accounts provide more precise pricing and faster execution.

- Think About Simplicity: If you’re new to trading, starting with a Standard account might help you ease into the process without overcomplicating your entry into the markets.

- Test Both Options: Many brokers, including Switch Markets, offer the ability to open multiple account types, including a demonstration account. Testing both can provide clarity on which suits you better in practice.

Switch Markets Account Comparison

Final Thoughts

While we have gone through the two types of trading accounts, choosing the very best one for you starts with a little introspection. Ask yourself:

- What timeframe do I take my entries from?

- Am I a scalper, a day trader, or a long-term trader?

- Will having a slightly larger spread make or break my trading edge?

Questions like these help you to bring the most important considerations into perspective because, in the end, there’s no intrinsic right or wrong choice.

To even help you get started without stress, Switch Markets offers both accounts to traders with as little as an initial deposit of $50.

Whether you opt for the transparency and precision of an ECN account or the simplicity of a Standard account, what matters most is aligning your choice with your trading strategy.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.